Lease Accounting

Lease Accounting for Teams Managing Complex Portfolios

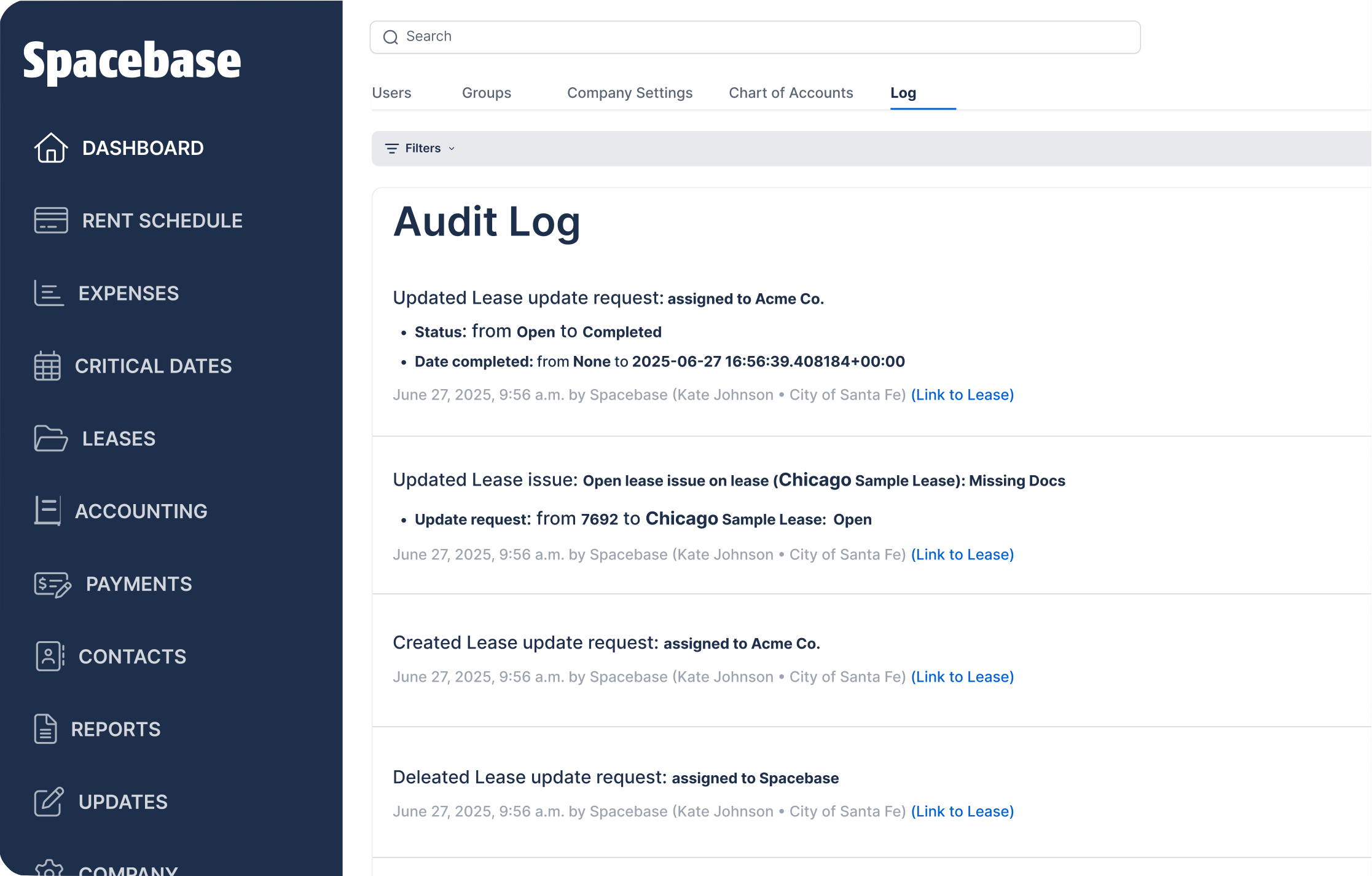

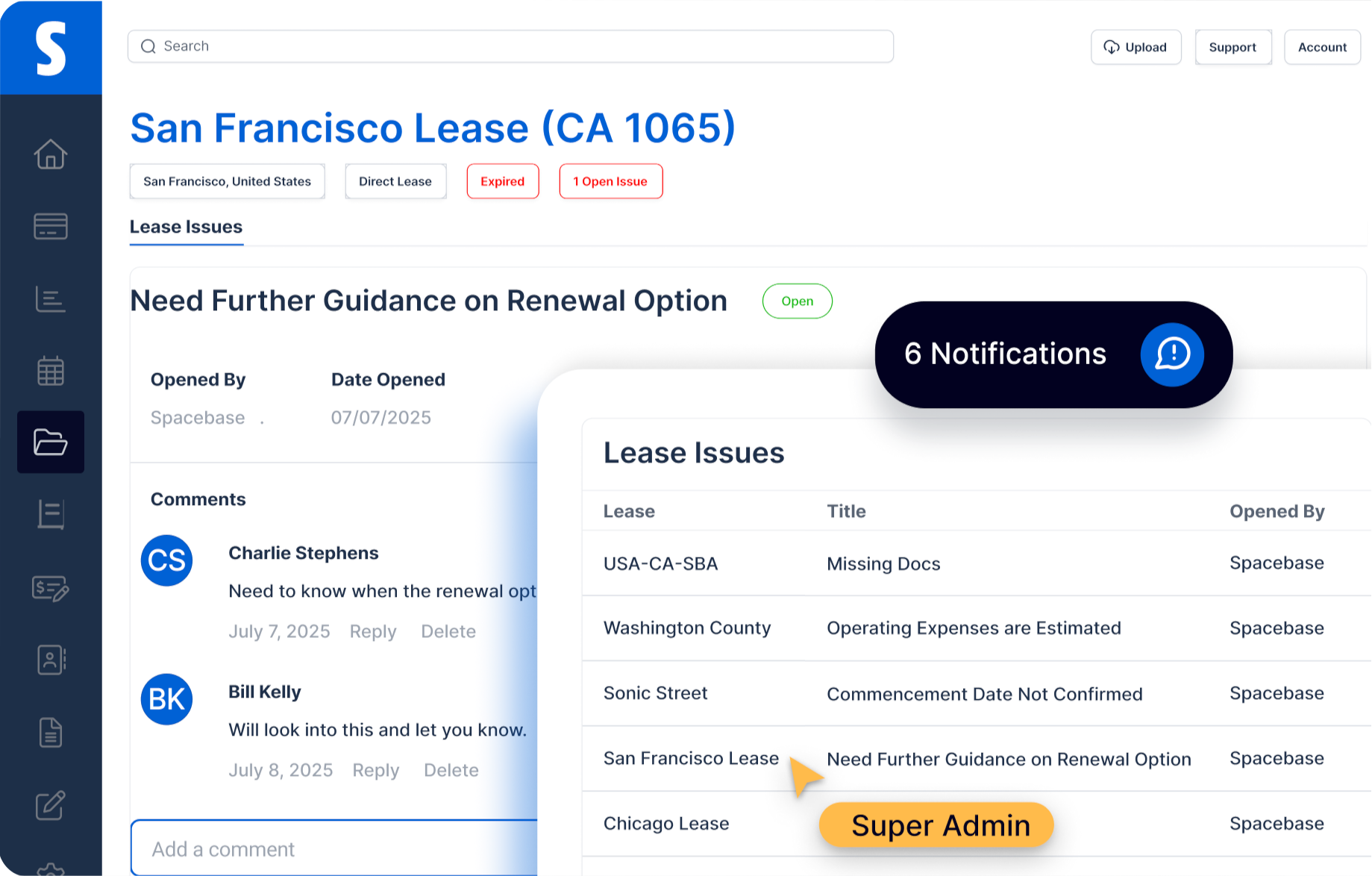

Spacebase helps accounting teams maintain defensible lease accounting as portfolios grow, change, and face increasing audit scrutiny. If you’re managing dozens or hundreds of leases across locations, asset types, or entities, accuracy and consistency start breaking down faster than most teams expect.

Loved by

Features Built to Simplify Lease Accounting

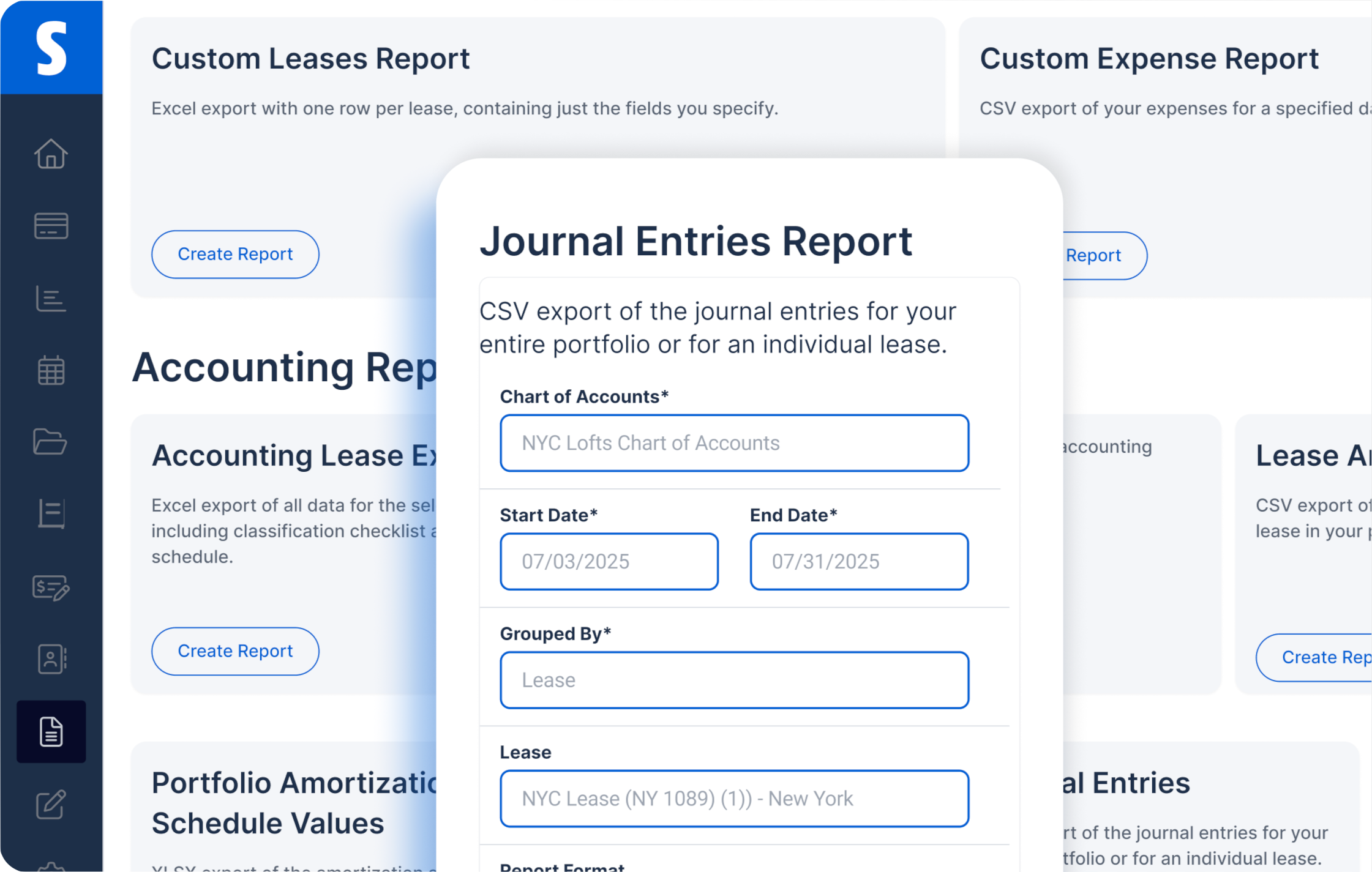

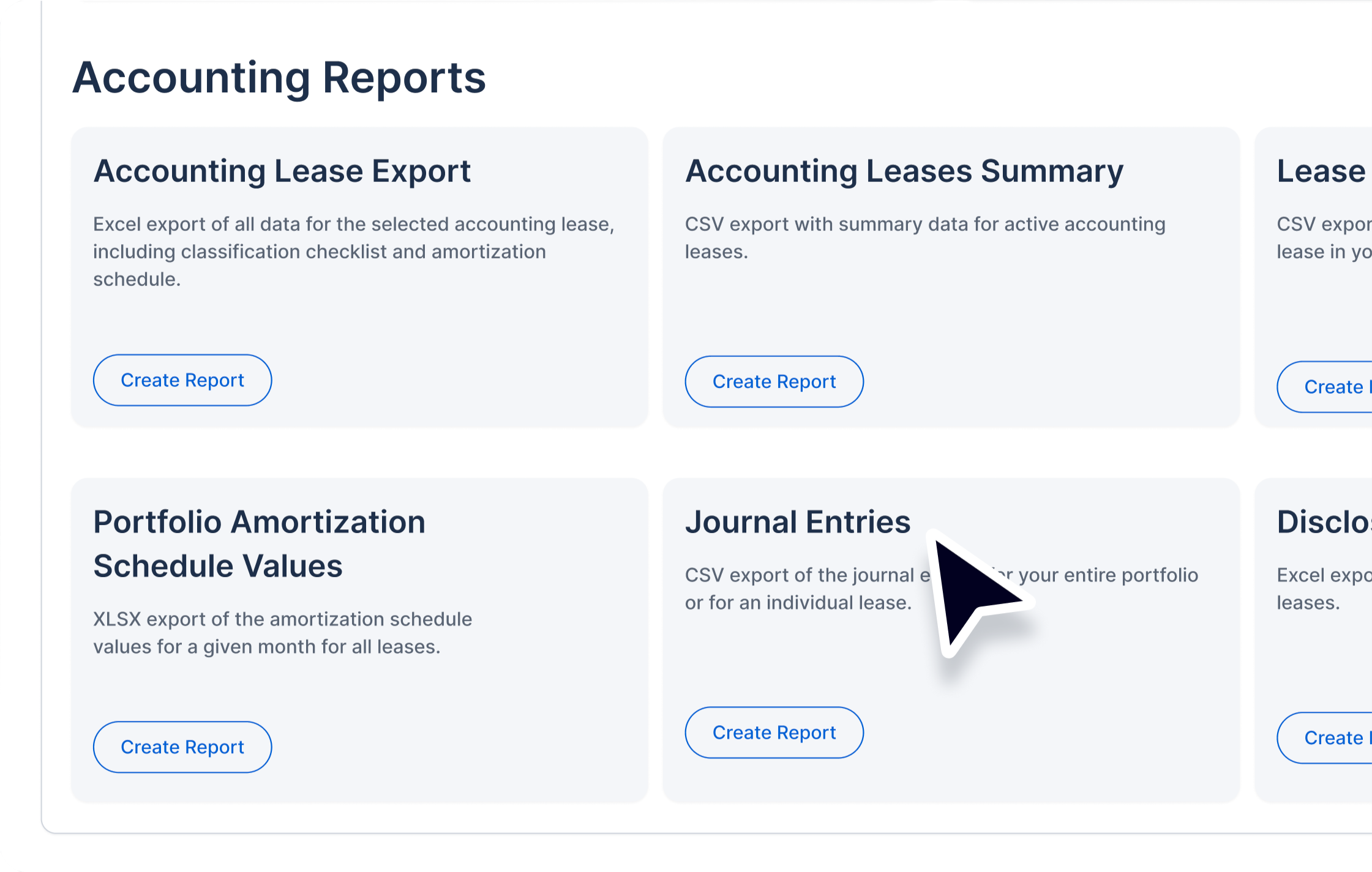

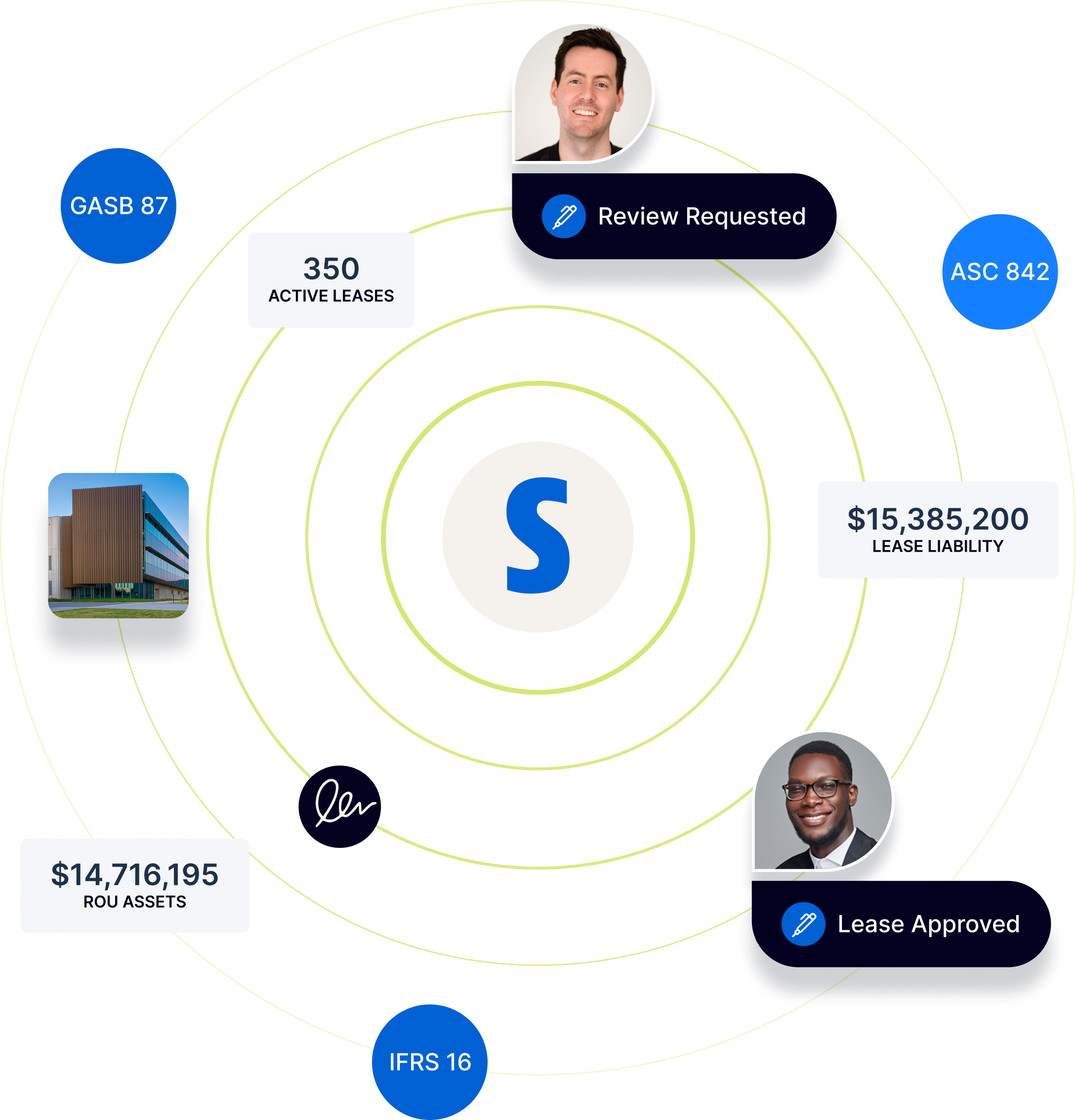

Spacebase automates ASC 842, GASB 87, and IFRS 16 compliance — recognizing the right-of-use (ROU) asset and lease liability at lease commencement, and automating journal entries, modifications, amortization schedules, and disclosures.

Enterprise-Grade Security

SOC 1 Type II Certified

Enterprise-grade security, verified. Our internal controls are independently audited and meet the rigorous standards of SOC 1 Type II, giving you peace of mind around financial reporting and data integrity.

The data

Results That Speak for Themselves

−300%

decrease in month-end close time

+25%

increase in modifications booked on time

+10%

increase in invoices paid on time

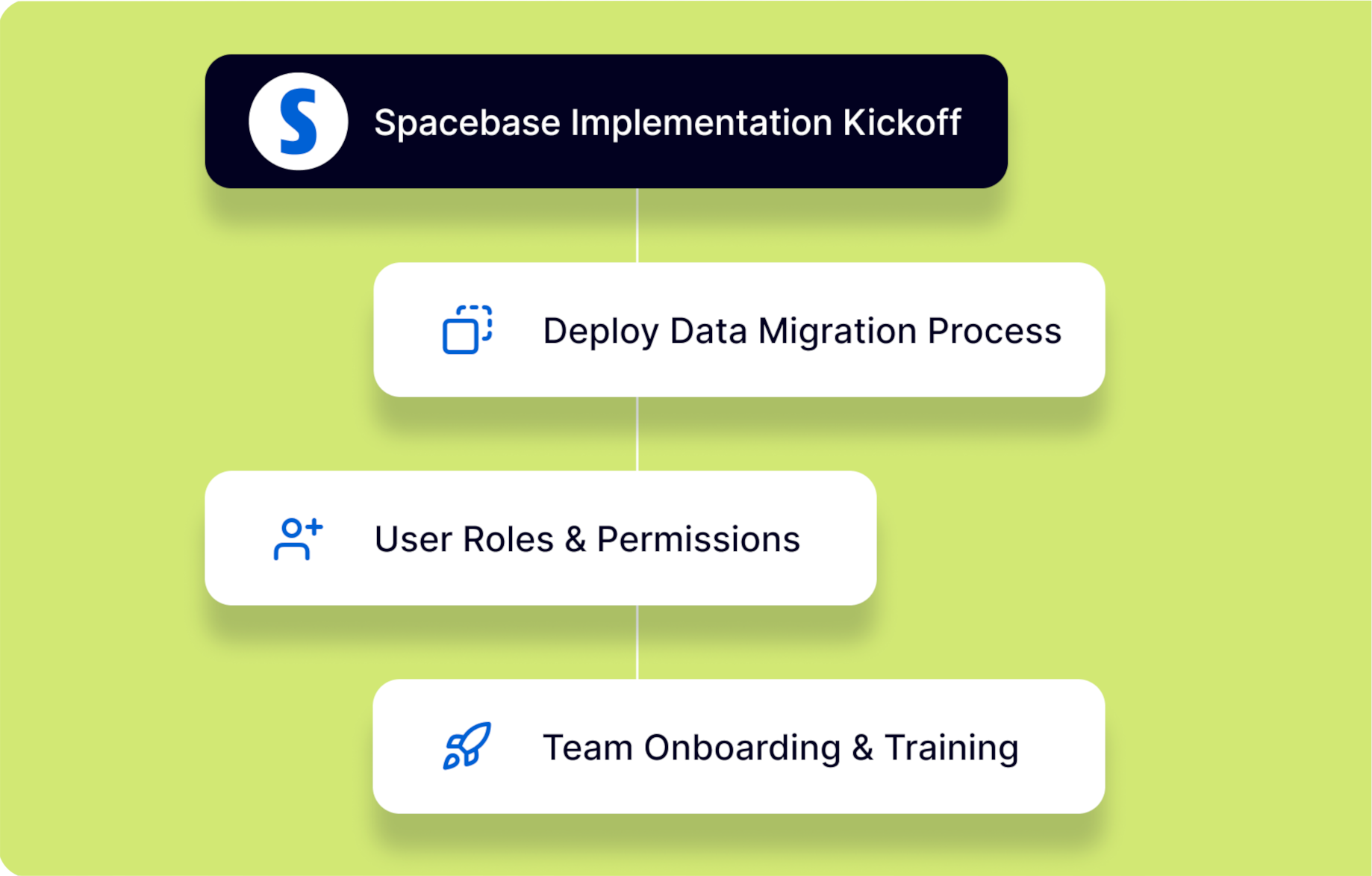

Hands-On Services to Support Your Success

From expert lease abstraction to guided implementation and dedicated support, our hands-on services are designed to help your team succeed at every stage. We’re here to simplify your processes and support your goals.

Markets we serve

The Software of Choice Across a Variety of Industries

From global SaaS firms to complex logistics operations, Spacebase supports finance teams across every sector.

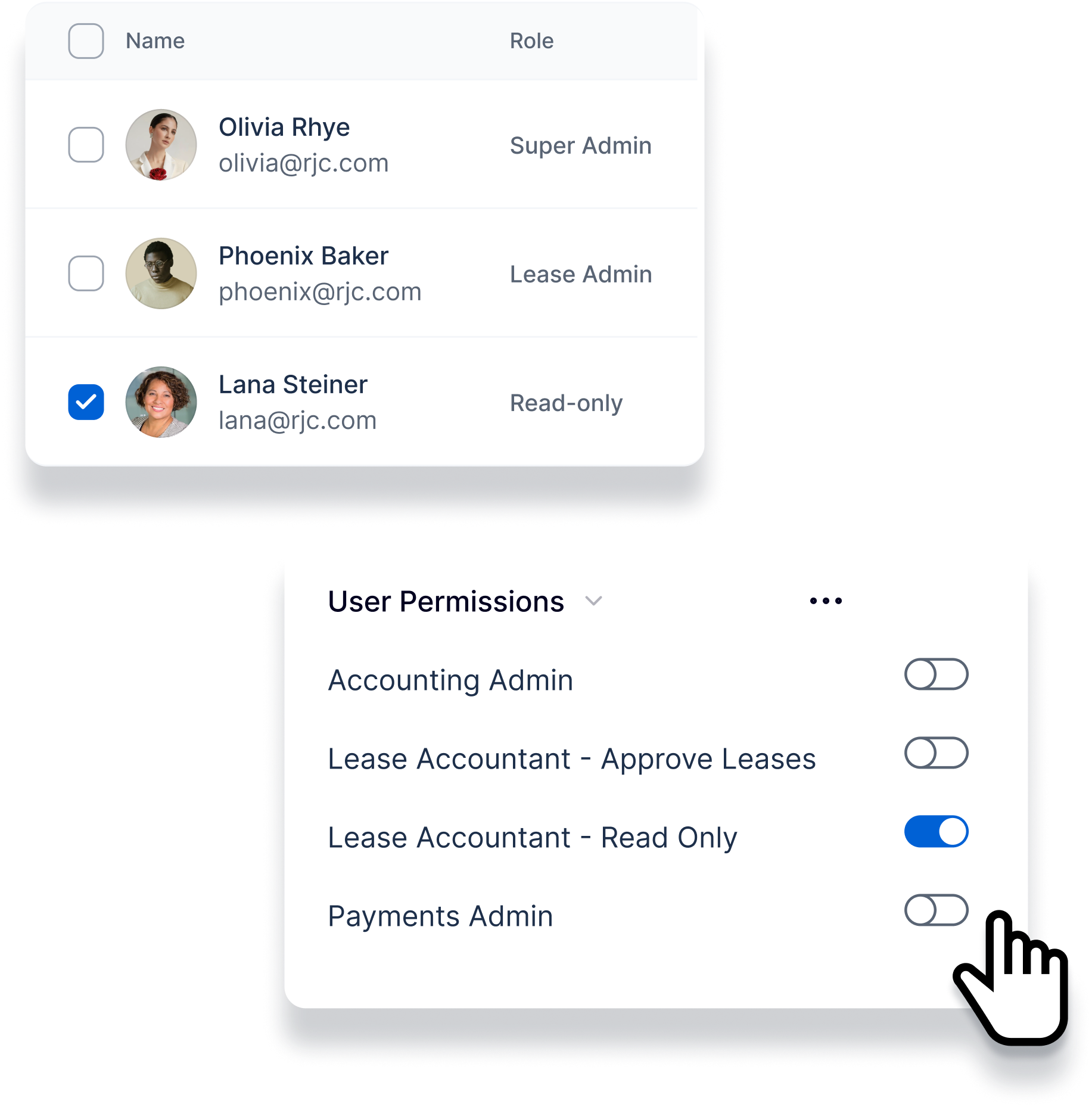

Scale your way

Simplify How Work Gets Done, So Your Whole Company Can Scale With You

Looking for something else?

Check Out Our Other Great Software

Choose what you need, when you need it. Spacebase is modular. You can start with lease accounting, lease administration, or both. Our platform is designed to adapt to your needs.

Lease Administration

If your team needs help managing critical dates, rent schedules, and day-to-day lease details, our lease administration solution is designed for you. Spacebase helps you stay organized and in control, without the complexity of lease accounting.

ExploreBeta

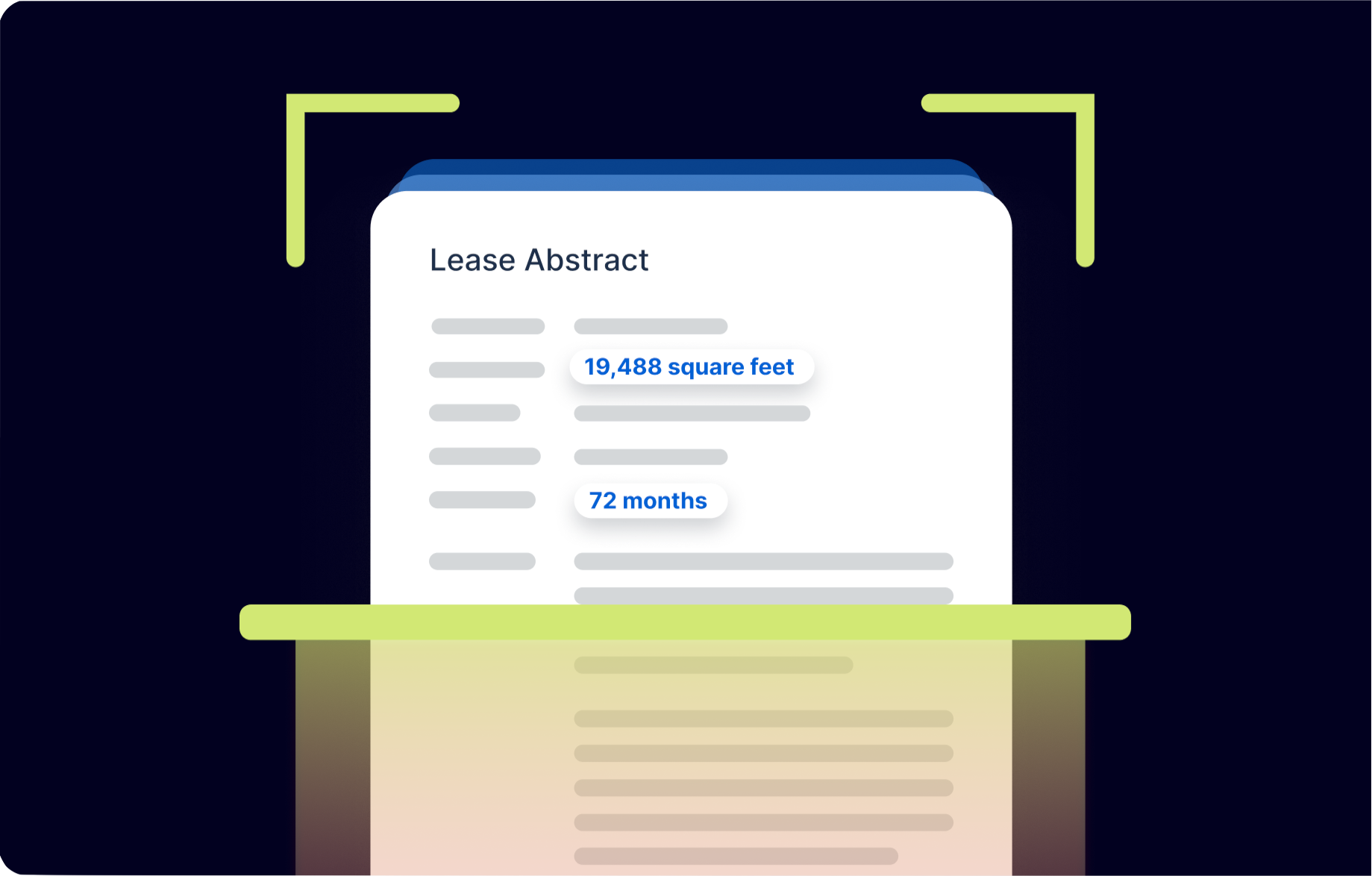

Spacebase AI is Built to Simplify Lease Abstraction and Document Processing

- Instantly identify key terms with optical character recognition (OCR)

- Automatically extract clauses, critical dates, and financials

- Reduce manual entry and improve accuracy across your lease data

- Formulate data analysis with the click of a button

Have questions? We have the answers

Frequently Asked Questions

What is lease accounting under ASC 842?

Lease accounting under ASC 842 requires a lessee to recognize a lease liability (present value of future lease payments) and a right-of-use (ROU) asset for virtually all leases (unless a short-term exemption is elected). It requires classification (finance vs operating), measurement of payments (fixed, in-substance fixed, and certain index-based variable payments), and specific disclosures.

How long does it take to implement lease management software?

Most Spacebase customers are up and running within a few weeks. Our team handles onboarding, data migration, and training, providing hands-on support every step of the way. For large or complex portfolios, we also offer custom implementation services and lease abstraction support.

Does Spacebase lease management software integrate with existing accounting systems?

Yes. Spacebase integrates with leading accounting platforms like NetSuite, Sage Intacct, QuickBooks, and more.

Can I use Spacebase lease management software on a mobile device?

Yes. Spacebase is entirely cloud-based and mobile-optimized, so you can access lease data, documents, and critical dates on any device, whether you’re at your desk or in the field.

How much does lease management software cost?

Spacebase offers flexible pricing based on your portfolio size and feature needs. Whether you're managing 20 leases or 2,000, we’ll tailor a package that fits your team. Request a demo to receive custom pricing tailored to your organization.

What’s the difference between lease administration and lease accounting?

Lease administration is about staying organized and compliant with lease terms. Lease accounting, on the other hand, involves translating those lease terms into accurate financial statements in accordance with standards such as ASC 842 or IFRS 16.

What does a lease administrator do?

A lease administrator handles the operational tasks involved in managing commercial leases. This includes maintaining lease records, ensuring timely payments, coordinating with landlords and internal teams, and keeping your lease data up-to-date and compliant.

What is commercial lease abstraction?

Commercial lease abstraction is the process of extracting key terms, dates, and clauses from a lease document and summarizing them in a structured, searchable format. Abstracts help your team quickly reference critical details without having to dig through lengthy contracts, and are essential for lease administration and accounting accuracy.