Understanding Right of Use Assets in Accounting

In the realm of accounting, understanding Right of Use (ROU) assets is crucial. These assets represent a significant shift in how leases are accounted for. With the introduction of IFRS 16, the landscape of lease accounting has transformed. This standard requires companies to recognize ROU assets on their balance sheets.

Lease accounting managers face the challenge of ensuring compliance with these standards. Aligning real estate and accounting teams is essential for accurate ROU asset management. This alignment helps in tracking lease modifications and maintaining audit-ready reports.

Effective ROU asset management impacts financial reporting and asset management strategies. It also plays a role in a company's financial health and performance metrics. This guide explores the mechanics of ROU assets and highlights the importance of cross-functional coordination.

What is a Right of Use Asset?

A Right of Use (ROU) asset represents a lessee’s right to use an identified asset for a period of time. Under IFRS 16, lessees are required to recognize this asset on the balance sheet, marking a departure from prior lease accounting standards.

This concept is based on control. The lessee must have the right to obtain substantially all economic benefits from use of the asset and the right to direct how and for what purpose the asset is used.

ROU assets commonly arise from leases of buildings, equipment, and vehicles. Key characteristics include:

- Control over use for a specified period

- Economic benefits obtained by the lessee

- Recognition on the balance sheet under IFRS 16

Understanding these criteria is essential for accurate lease classification and reporting. Misapplication can lead to misstated assets and liabilities, particularly in complex portfolios.

The Impact of IFRS 16 on Lease Accounting

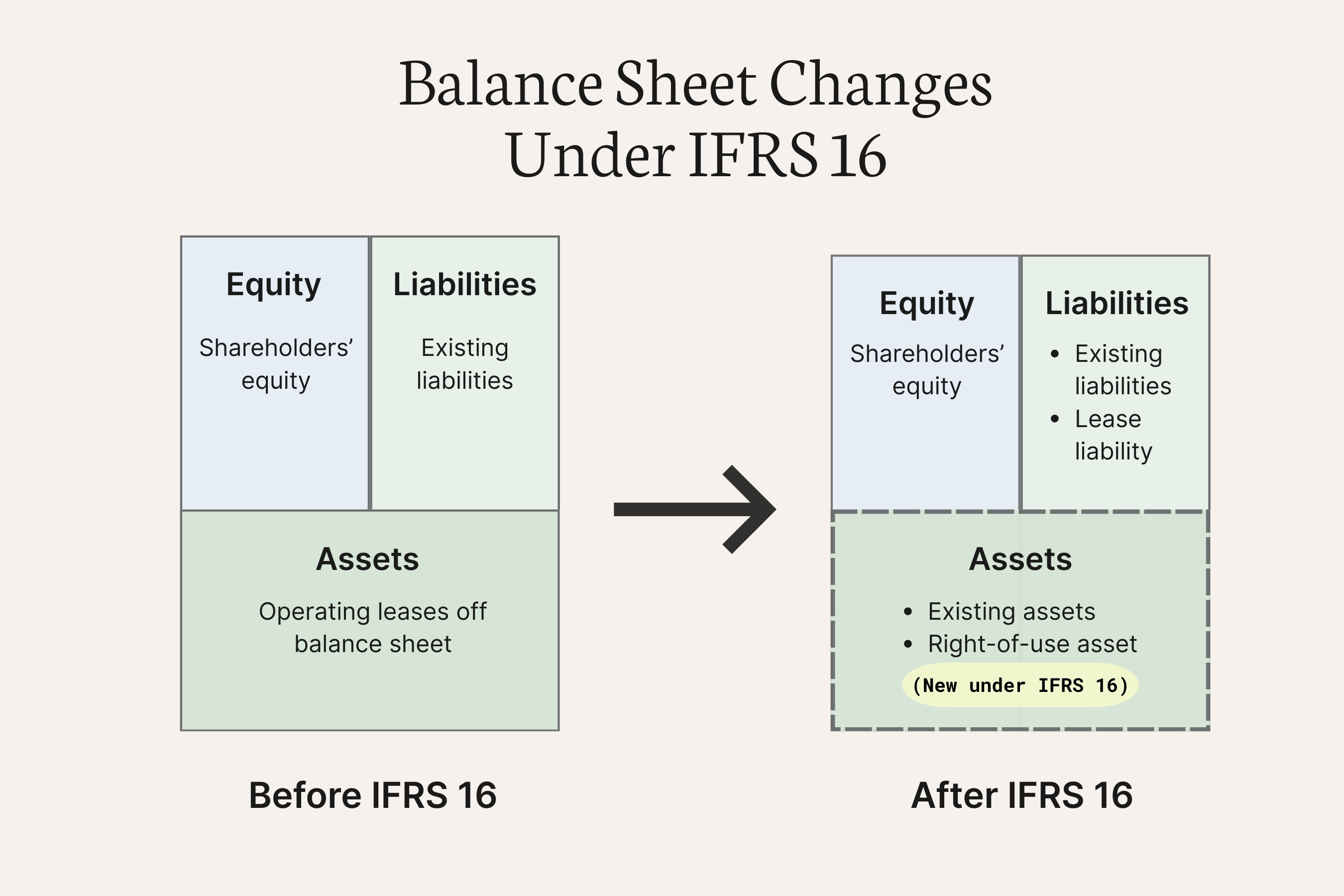

IFRS 16 significantly changes how leases are reflected in financial statements. For lessees, the standard removes the distinction between operating and finance leases.

Under IFRS 16, lease obligations are recognized through a right-of-use asset and a corresponding lease liability, increasing transparency and reducing off-balance-sheet financing.

Key impacts include:

- Improved comparability between organizations

- Changes to leverage and performance ratios

- Potential effects on debt covenants

Transitioning to IFRS 16 requires accurate lease data and disciplined processes. Accounting teams rely on complete and current lease information to ensure reliable measurement and disclosure.

Cross-functional coordination is critical. Lease amendments, renewals, and reassessments must be communicated promptly to ensure balances remain accurate and defensible during audit review.

Initial Recognition and Measurement of ROU Assets

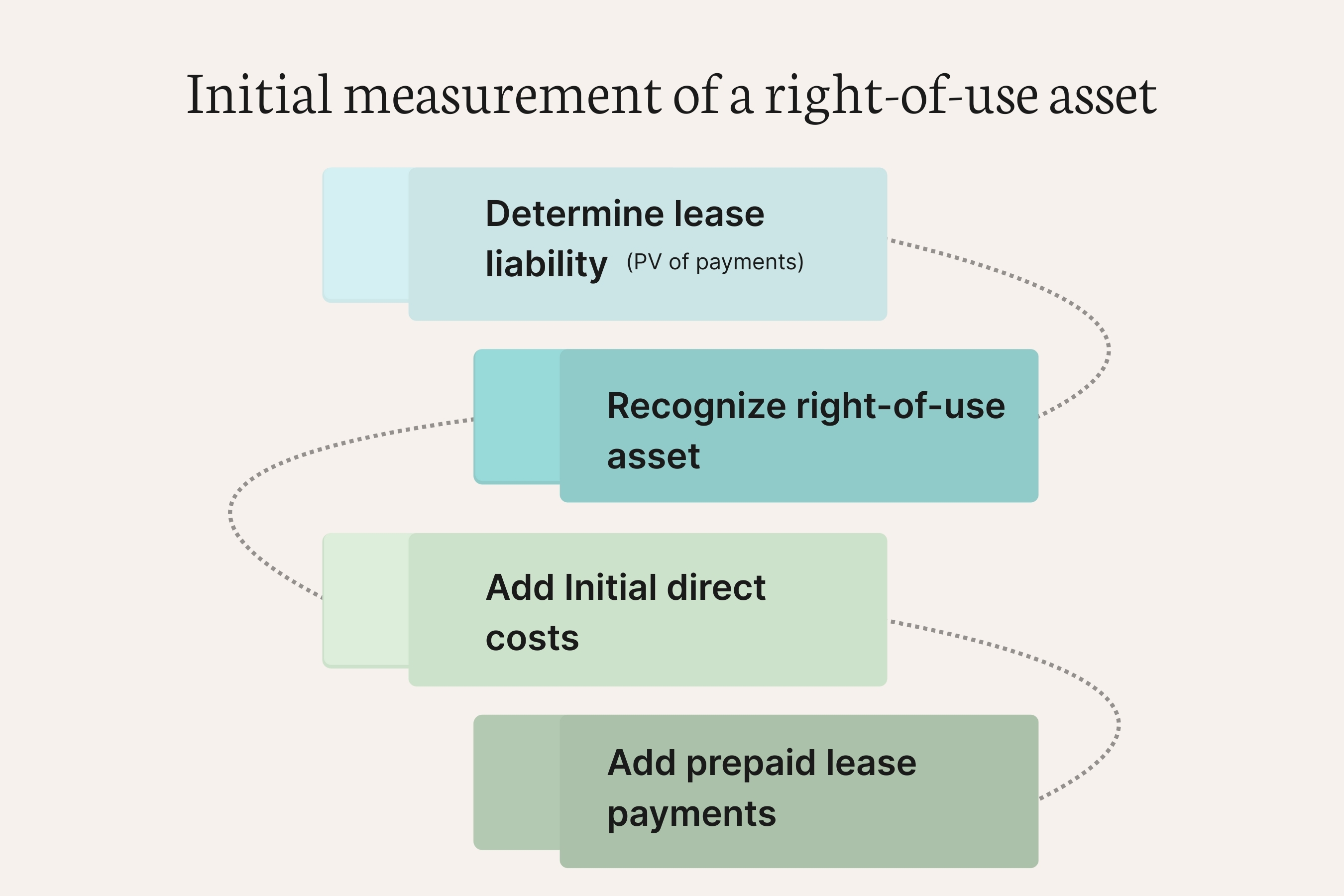

At lease commencement, both a right-of-use asset and a lease liability are recognized on the balance sheet. The ROU asset is initially measured at cost.

This cost includes:

- The initial measurement of the lease liability, calculated as the present value of lease payments

- Lease payments made at or before the commencement date

- Initial direct costs incurred by the lessee

The ROU asset also incorporates initial estimates of dismantling or restoration obligations when such provisions are recognized under IAS 37.

Accurate initial measurement is critical, as errors at commencement flow through amortization, interest expense, and subsequent remeasurements. Coordination between accounting and real estate teams helps ensure assumptions and inputs are complete and supportable.

Subsequent Measurement and Amortization

Following initial recognition, the ROU asset is amortized over the shorter of the lease term or the asset’s useful life, typically on a straight-line basis unless another pattern better reflects usage.

In addition to amortization, ROU assets are subject to impairment testing. Indicators such as underutilization, site closures, or adverse market conditions may trigger a review.

Key elements of subsequent measurement include:

- Appropriate amortization methodology

- Periodic impairment assessments

- Adjustments resulting from lease modifications or reassessments

ROU assets are tested for impairment in accordance with IAS 36, consistent with other non-financial assets.

Lease Modifications, Reassessments, and Impairment

Lease modifications introduce complexity into ROU asset accounting. Changes such as term extensions, space reductions, or payment adjustments require reassessment of both the lease liability and the ROU asset.

Failure to reassess can result in misstatements and weakened audit defensibility. Regular review of lease events is essential to maintain accurate balances.

Impairment occurs when the carrying amount of an ROU asset exceeds its recoverable amount. Ongoing monitoring helps ensure losses are identified and recorded in a timely manner.

Key considerations include:

- Timely identification and documentation of lease changes

- Reassessment of lease terms and discount rates

- Consistent impairment testing where indicators exist

ROU Assets in Financial Reporting and Balance Sheets

ROU assets increase transparency by bringing lease commitments onto the balance sheet. They are generally presented within non-current assets, subject to company policy and lease term.

Financial statement disclosures related to ROU assets typically include:

- Maturity analysis of lease liabilities

- Information on variable lease payments

- Impacts on cash flows and expense presentation

Clear presentation and disclosure help stakeholders understand the scale and nature of lease obligations and support audit review.

Cross-Functional Alignment: Real Estate, Accounting, and Asset Management

Effective ROU asset management depends on coordination across teams. Real estate teams negotiate lease terms, accounting teams assess financial impact, and asset management monitors utilization and performance.

Alignment reduces risk and improves reporting accuracy. Practical steps include:

- Defined communication protocols for lease changes

- Regular cross-functional check-ins

- Shared systems for lease data and documentation

Strong coordination supports compliance with IFRS 16 and improves confidence in reported results.

Best Practices for Compliance and Audit-Ready Reporting

Producing audit-ready lease reporting requires consistent application of IFRS 16 and well-documented processes.

Best practices include:

- Ongoing training on lease accounting requirements

- Detailed documentation of assumptions and judgments

- Regular internal reviews of lease data and calculations

These practices reduce audit friction and support reliable financial reporting as portfolios grow.

Technology and Tools for ROU Asset Management

Technology plays a central role in managing ROU assets at scale. Lease accounting systems help standardize calculations, track changes, and maintain an audit trail.

Key capabilities include:

- Structured lease data capture

- Automated present value calculations

- Reporting and disclosure support

Adopting purpose-built tools reduces manual effort and improves accuracy across the lease lifecycle.

Common Challenges and How to Overcome Them

Organizations commonly face challenges such as incomplete lease data, inconsistent assumptions, and delayed communication between teams.

Mitigation strategies include:

- Standardized intake and review processes

- Clear ownership of lease updates

- Periodic training and process refreshes

Addressing these issues supports cleaner reporting and stronger audit outcomes.

Strategic Insights: Leveraging ROU Assets for Business Value

Beyond compliance, ROU assets provide insight into long-term occupancy and equipment commitments. When integrated into planning, they support better capital allocation and portfolio decisions.

Key considerations include:

- Incorporating lease obligations into financial forecasting

- Monitoring utilization and renewal risk

- Aligning lease strategy with broader business objectives

Treating ROU assets as strategic data points enables more informed decision-making.

Conclusion: The Future of ROU Asset Management

As lease portfolios grow and standards continue to evolve, disciplined ROU asset management remains essential. Organizations that combine strong processes, cross-functional alignment, and reliable systems are better positioned to maintain compliance and transparency.

By embedding ROU asset considerations into financial planning and operations, companies can support audit readiness while gaining clearer insight into their lease commitments.

Questions about your lease accounting process or how right-of-use assets are being handled across your portfolio? Our team works closely with accounting and real estate teams to support accurate ROU asset calculations, ongoing remeasurements, and audit-ready reporting as portfolios scale. Connect with our team here to see how Spacebase supports lease accounting under IFRS 16.

Brooke Colglazier

Marketing Manager