Understanding Lease Amortization Schedules: What They Include and Why They Matter

Lease accounting isn’t just about compliance; it’s about control, accuracy, and visibility. At its core, lease accounting under standards like ASC 842 and IFRS 16 is the lease amortization schedule. It’s a document that doesn’t often get much attention, but behind the scenes, it drives critical journal entries, balance sheet accuracy, and audit readiness.

In this guide, we’ll break down what a lease amortization schedule is, how it’s built, what it’s used for, and how automating it can eliminate risk and unlock better financial decision-making.

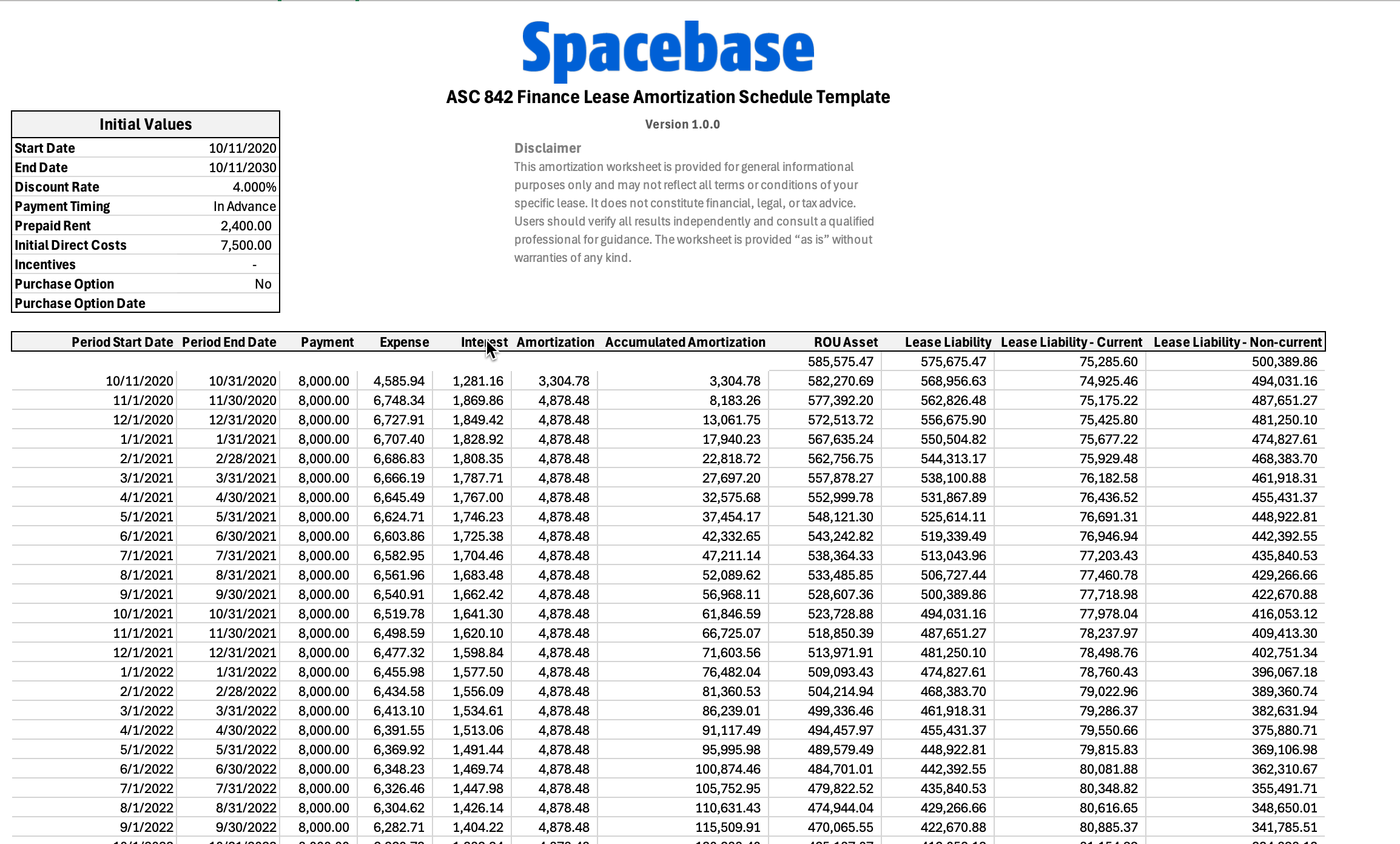

To help finance teams model lease liabilities and right-of-use asset amortization under ASC 842 and IFRS 16, we’ve created a downloadable lease amortization schedule template in Excel. This template automatically calculates interest expense, principal reduction, and ending lease liability.

Download our free Lease Amortization Schedule Excel template

What is a Lease Amortization Schedule?

A lease amortization schedule outlines how a lease liability is reduced over time. It breaks down each monthly lease payment into two parts: one portion that reduces the lease liability and another that accounts for interest expense.

This is especially important under ASC 842 and IFRS 16, where companies must recognize both a right-of-use (ROU) asset and a lease liability on the balance sheet. The amortization schedule tells the story of how that liability changes with each passing month and ensures the numbers in your journal entries, trial balance, and financial reports all tie together.

Key Components of the Schedule

A typical amortization schedule includes:

- Opening balance: The starting lease liability at lease commencement.

- Monthly payment: The full amount due for that period, based on the lease agreement.

- Interest expense: Calculated by multiplying the opening balance by the discount rate.

- Principal reduction: The portion of the payment that reduces the liability.

- Closing balance: The new liability after the monthly payment is applied.

Each row in the schedule corresponds to a specific period, usually monthly, and builds sequentially over the lease term.

What Do You Need to Generate One?

To build an accurate amortization schedule, you need to capture a few key data points from each lease:

- Lease term: Start and end dates, including renewal options if reasonably sure.

- Payment structure: Base rent, escalations, abatements, and variable components.

- Discount rate: Typically, the incremental borrowing rate (IBR), unless the implicit rate is known.

- Commencement date: When the lease officially begins and the asset is made available for use.

From these inputs, you can calculate the present value of lease payments (the opening liability) and generate the full schedule.

How Finance Teams Use the Amortization Schedule

The amortization schedule is more than a reference; it’s a functional tool used across the accounting cycle. Here’s how:

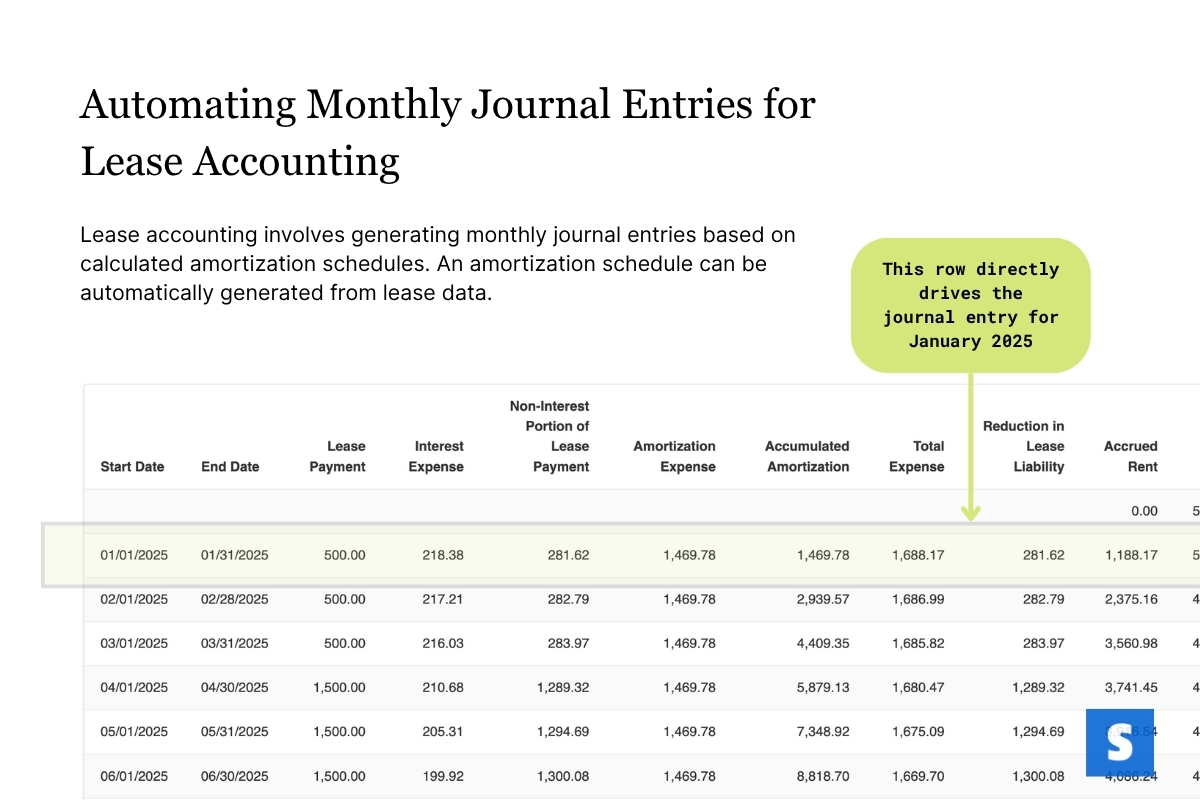

- Journal entries: Each month, your schedule provides the exact amounts to debit and credit for lease liability, ROU asset amortization, and interest expense.

The amortization schedule forms the foundation of monthly journal entries in lease accounting. Each row represents a single period and drives the corresponding journal entry. For example, here’s how January 2025 is broken down:

-

Balance sheet support: The closing balances reconcile directly with your general ledger.

-

Audit preparation: Auditors frequently request lease amortization schedules to confirm compliance and calculations.

-

Forecasting: Knowing how liabilities decline over time helps inform long-term planning and capital allocation.

Why Manual Tools Fall Short

Spreadsheets and legacy tools may work for a handful of leases—but they don’t scale. Common issues include:

- Formula errors: A single miskeyed rate or date throws off your entire schedule.

- Version control: Files get copied, adjusted, and saved in ways that make traceability difficult.

- No built-in checks: There's no validation for date mismatches, incorrect IBRs, or missed escalations.

- Lack of audit trail: Auditors want to see how calculations are generated and approved, not just the end result.

How Spacebase Automates Amortization Schedules

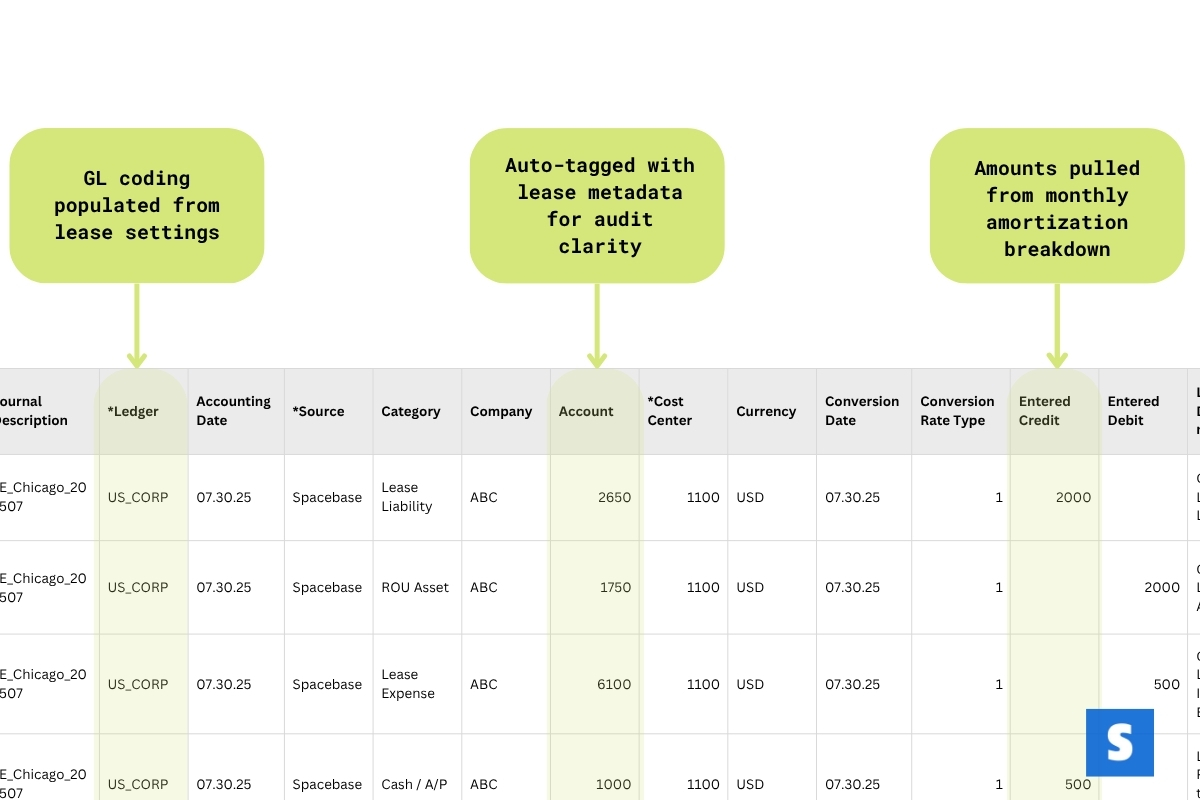

Instead of manually calculating schedules, Spacebase automatically generates them from your lease data, eliminating the need for spreadsheets.

Here’s how it works:

- Lease terms and payment data are entered once or abstracted via our admin tools.

- The system applies your accounting settings, including discount rates, straight-line logic, and calendar preferences.

- The full amortization schedule is generated and tied to your journal entries, accounting reports, and audit exports.

- Schedules can be updated if terms change, such as a lease extension or early termination, and changes are versioned automatically.

With automation, accuracy is built in, and finance teams can spend less time double-checking formulas and more time analyzing what matters.

Spacebase automatically pulls lease metadata, applies GL coding from lease settings, and tags each amount accordingly for accounting and audit clarity.

More Than Compliance: A Tool for Strategic Finance

Accurate amortization schedules give you a clear view of how lease liabilities evolve over time. That insight can help with:

- Cash flow planning: See future payment obligations and adjust budgets accordingly.

- Entity-level analysis: Understand how leases affect each business unit or region.

- Portfolio optimization: Make more informed decisions about renewals, exits, and restructures.

Conclusion

Lease amortization schedules are the foundation of lease accounting. When managed manually, they introduce risk. When automated and connected, they unlock accuracy, control, and strategic visibility.

Want to see how Spacebase simplifies amortization schedules and financial reporting?

Schedule a demo to get a firsthand look.

Brooke Colglazier

Marketing Manager