The CFO’s Guide to Lease Visibility

How to Stay Ahead of Audit Risk, Compliance Gaps, and Financial Surprises

As a CFO, your job is to manage financial clarity, compliance risk, and strategic planning across the organization. And while lease obligations might not be your daily focus, they sit quietly on your balance sheet, impacting EBITDA, debt covenants, and audit timelines.

If you're hearing about ASC 842 from your finance team, it might already be too late.

You don’t need to understand every nuance of lease accounting, but you do need visibility into what’s at stake and whether your current lease processes are quietly putting you at risk.

When Compliance Becomes a CFO-Level Problem

In a perfect world, your accounting and real estate teams would manage lease obligations without issues. But that’s not always the case.

Ask yourself:

- Are all leases accounted for, including short-term or embedded ones?

- Are we proactively tracking renewals, terminations, and rent escalations?

- Can we generate audit-ready disclosure reports without manual work?

If the answer is "I'm not sure", that's your signal. Lack of lease visibility isn't just an accounting issue; it becomes a business risk.

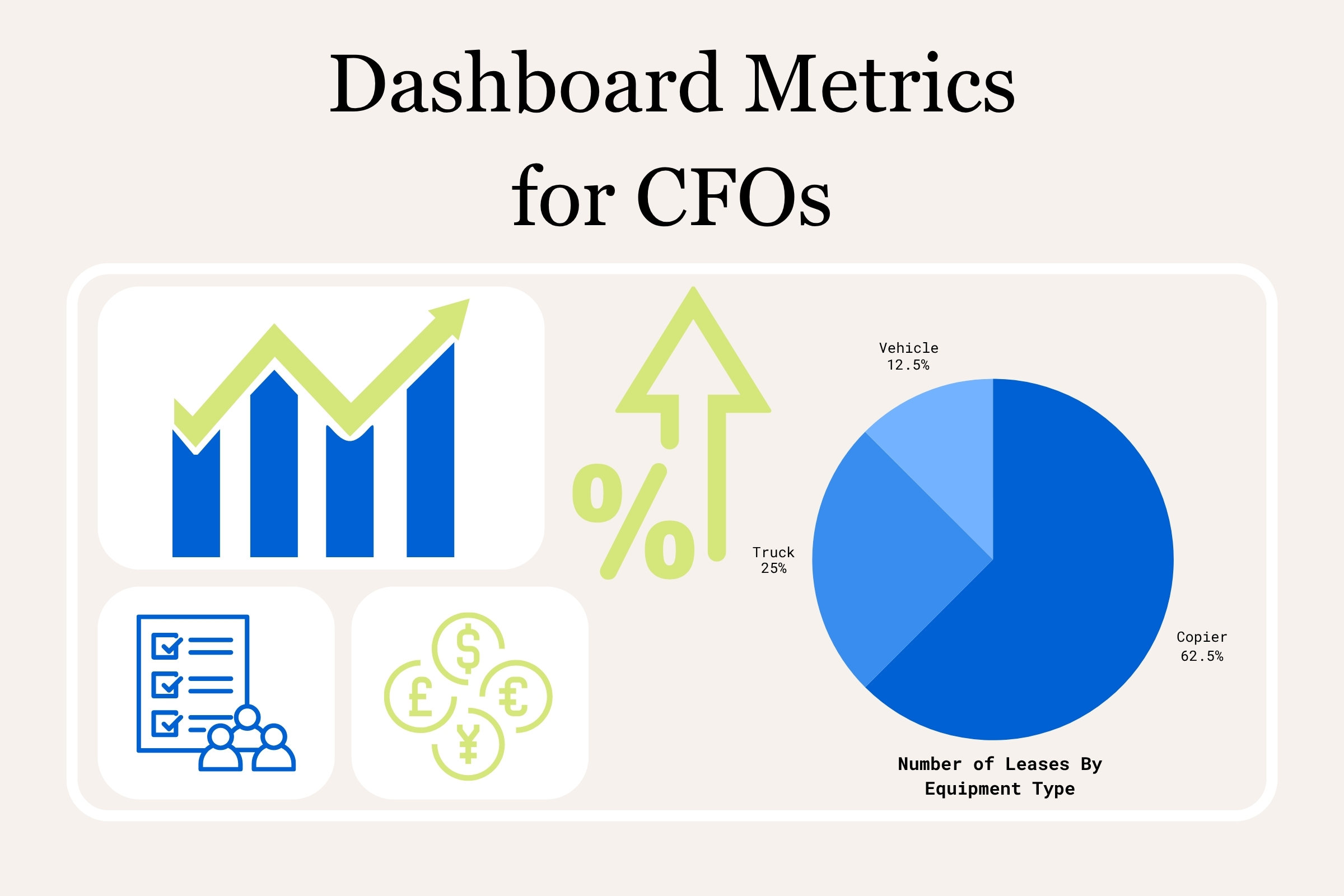

The Reports and Metrics That Give You Visibility

You don’t need to manage every detail, but you should know what to review and what signals trouble.

Reports You Should Be Reviewing

These core reports support compliance and provide the data to identify exposure early.

1. Amortization Schedules

Show how lease liabilities and right-of-use assets change over time.

Look for: Large shifts, missing leases, or inconsistent balances with your GL.

2. Disclosure Footnotes

Required for ASC 842 reporting, includes total lease expense, weighted averages, and discount rates.

Look for: Completeness, accuracy, and unusual year-over-year changes.

3. Rollforward Reports

Track new leases, terminations, and modifications across periods.

Look for: Missing entries, undocumented changes, or unbalanced movement.

4. Journal Entry Logs

List of accounting entries posted from your lease system.

Look for: Misclassifications, excessive manual edits, or GL mismatches.

5. Critical Date Calendars

Highlight key lease events, such as renewals, terminations, and CPI increases.

Look for: Upcoming expirations, missed options, or misaligned data between teams.

What This Means for You

Lease data influences far more than accounting. It shapes:

- Audit readiness

- Financial forecasts

- Asset strategies

- Overall operational risk

If your team can’t produce audit-ready lease data in real time, you’re vulnerable—not just during audit season, but every day decisions rely on that data being accurate.

It’s Not About ASC 842. It’s About Control.

You don’t need to manage the details of ASC 842, but you should feel confident that your team has it handled. If they’re explaining the regulation to you, something might already be broken.

Modern lease software helps your team stay compliant while giving you the insight to lead.

When your next audit comes around, you want to be answering questions, not scrambling for answers.

Visibility drives smarter decisions. And smarter decisions keep you audit-ready, risk-aware, and in control.

Visibility drives smarter decisions. And smarter decisions keep you audit-ready, risk-aware, and in control.

Where Real Estate Meets the Balance Sheet

Your company’s leased properties aren’t just accounting entries; they're strategic assets. Whether it’s offices, warehouses, data centers, or retail spaces, each lease represents a physical commitment with long-term financial impact.

Poor visibility into your commercial real estate portfolio can lead to:

- Missed renewal or termination deadlines

- Surprises in occupancy costs

- Redundant or underutilized space

- Lease misalignments that affect budgeting and staffing

Lease data isn’t just for auditors; it powers real estate decisions that affect cash flow, growth planning, and operational agility. As CFO, you need to be confident that the data your real estate team relies on is complete, accurate, and aligned with your financial strategy.

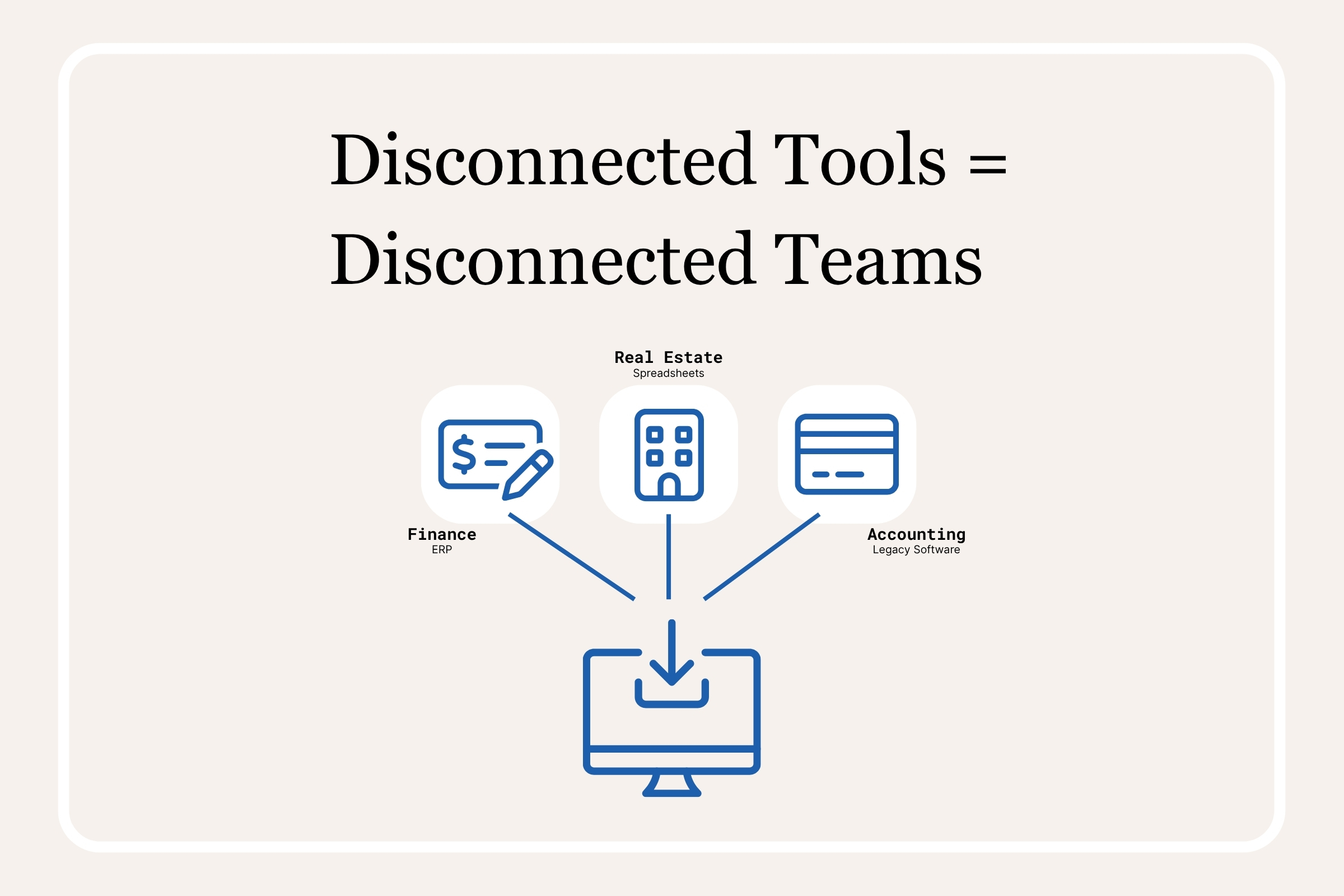

If finance, real estate, and accounting teams are all using different tools, or worse, different spreadsheets, gaps are inevitable.

Final Thought

Lease compliance isn’t just a technical issue; it’s a visibility issue. If your financial tools don’t give you real-time insight into one of your company’s largest liabilities, it’s time to reassess.

Visibility drives smarter decisions. And smarter decisions keep you audit-ready, risk-aware, and in control.

About Spacebase

Spacebase is modern lease administration and accounting software designed to give finance, real estate, and accounting teams one unified source of truth. Whether you're preparing for an audit, tracking critical lease dates, or forecasting occupancy costs, Spacebase helps you stay compliant, stay aligned, and stay in control.

Ready to get visibility into your leases? Request a demo and see how Spacebase makes lease management simpler for everyone.

Brooke Colglazier

Marketing Manager