Tracking Equipment Leases: Where Visibility Breaks Down as Portfolios Grow

As lease portfolios expand, many organizations find that equipment leases are the first category to lose visibility. While real estate leases often follow standardized terms and long lifecycles, equipment leases introduce greater variability in structure, assumptions, and operational ownership. Over time, this variability exposes weaknesses in existing tracking processes and increases the risk of incomplete data, inconsistent reporting, and audit challenges.

Tracking equipment leases effectively requires more than capturing payment schedules. These leases demand asset-level detail, ongoing updates, and clear ownership across functions. Without a repeatable and scalable approach, incremental growth in equipment leases results in disproportionate increases in effort and risk.

This article examines why equipment leases are uniquely difficult to track, where breakdowns most commonly occur, and what foundational elements are required to maintain visibility as portfolios grow.

Why Equipment Leases Are Harder to Track Than They Appear

Equipment leases differ from real estate leases in ways that are operationally significant. While real estate leases are typically tied to locations, square footage, and predictable rent escalations, equipment leases are driven by the characteristics and use of individual assets.

In practice, equipment leases often involve:

- Shorter lease terms and more frequent renewals

- Asset-specific assumptions, such as useful life and depreciation

- Usage-based or non-standard payment structures

- Modifications as equipment is upgraded, replaced, or redeployed

As a result, tracking equipment leases requires a level of detail and maintenance that many existing processes were not designed to support. When these leases are managed using the same approach as real estate leases, gaps in visibility emerge quickly.

Common Failure Points in Equipment Lease Tracking

Fragmented Ownership Across Teams

One of the most common challenges in tracking equipment leases is unclear ownership. Equipment may be sourced and negotiated by operations, IT, or procurement teams, while Accounting is responsible for recognition and reporting. Without a defined intake and communication process, critical lease information may never reach the teams responsible for tracking it.

This disconnect can result in leases being executed without Accounting’s awareness until payments begin, at which point assumptions must be reconstructed after the fact. Over time, this reactive approach increases the likelihood of errors and inconsistent treatment across similar assets.

Incomplete or Decentralized Lease Data

Equipment leases are frequently embedded within service agreements, master contracts, or bundled vendor arrangements. When lease documents are stored across emails, shared drives, or disconnected systems, it becomes difficult to assert the completeness and accuracy of the lease population.

As equipment leases are amended, extended, or modified, maintaining a complete historical record is essential. Missing documentation or overlooked amendments can materially affect classification, measurement, and ongoing reporting, particularly under ASC 842 and IFRS 16.

Spreadsheet-Based Tracking That Does Not Scale

Many organizations initially rely on spreadsheets to track equipment leases due to their flexibility and accessibility. While spreadsheets may be sufficient at low volumes, they introduce significant risk as portfolios grow.

Common issues include:

- Manual data entry errors

- Broken formulas or inconsistent assumptions

- Lack of version control

- Limited audit trails and approval history

As the number of equipment leases increases, the effort required to maintain these spreadsheets grows disproportionately. What begins as a manageable workaround becomes a structural limitation that hinders scalability.

Inconsistent Assumptions Across Assets

Equipment leases often require asset-specific judgments related to useful life, residual value, and renewal expectations. Without standardized policies and centralized oversight, these assumptions may be applied inconsistently across similar leases.

Inconsistent assumptions not only affect financial reporting but also complicate audit review and internal analysis. Reconciling differences after the fact consumes time and increases the risk of misstatements.

What Effective Equipment Lease Tracking Requires

Centralized Lease Records

A centralized repository for all lease agreements ensures that complete and current information is accessible to all relevant stakeholders. This includes original contracts, amendments, and supporting documentation. Centralization is critical for asserting completeness and supporting audit and compliance requirements.

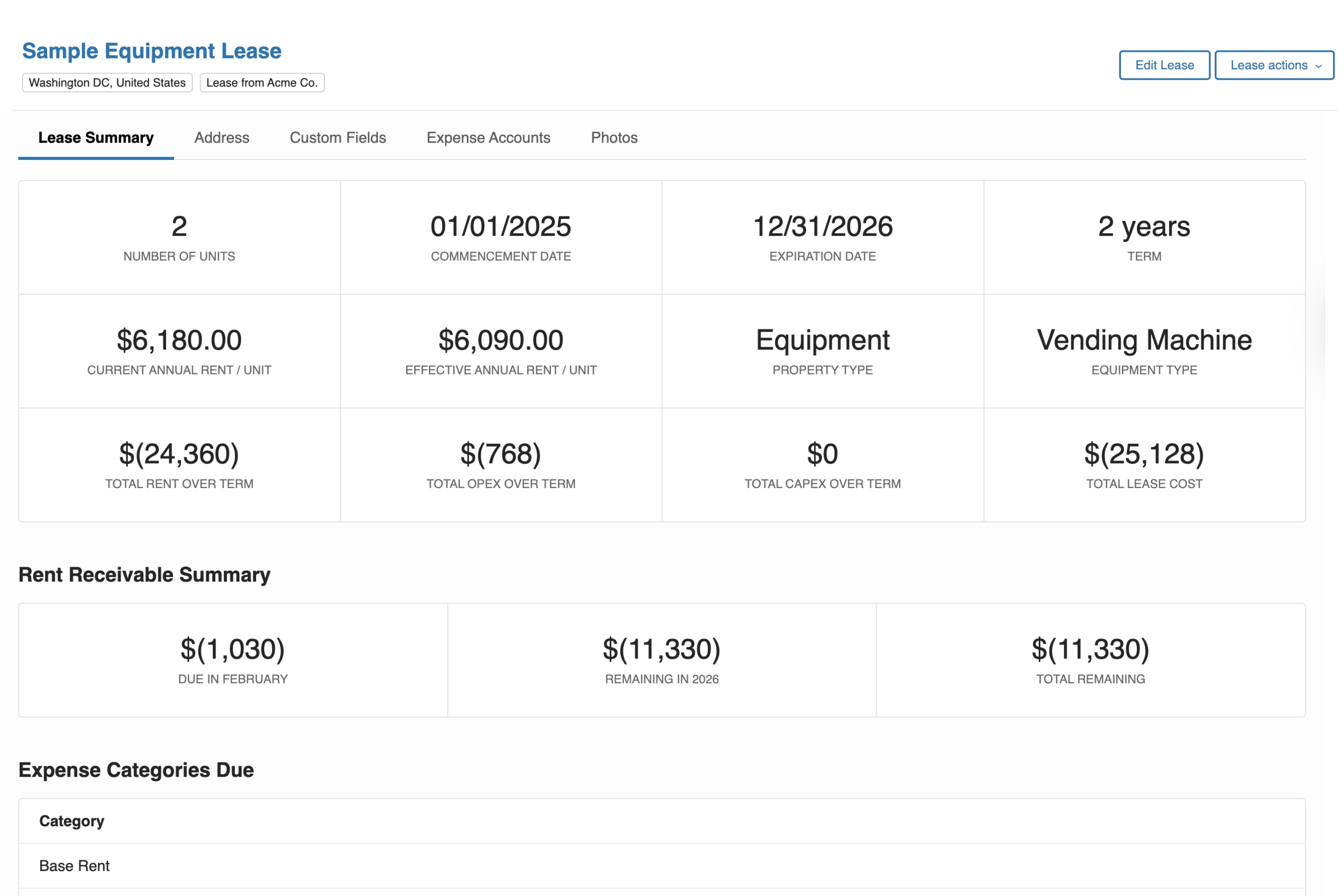

Example of an equipment lease record showing asset-specific terms and assumptions tracked independently from real estate leases.

Defined Intake and Review Processes

Effective tracking begins at lease execution. A defined intake process ensures that new equipment leases are captured promptly, reviewed consistently, and classified correctly. Clear handoffs between operational teams and Accounting reduce reliance on reactive cleanup and rework.

Standardized Assumptions and Policies

Documented policies governing classification, discount rates, useful life assumptions, and modification treatment provide consistency across the portfolio. These policies serve as a reference point for Accounting and as guidance for other teams whose decisions impact lease reporting.

Asset-Level Visibility Over the Lease Lifecycle

Equipment leases require tracking beyond payment schedules. Visibility into key dates, modifications, renewals, and asset-specific assumptions is essential to maintaining accurate records over time. Systems and processes should support this level of detail without introducing manual effort.

Conclusion

Tracking equipment leases becomes increasingly complex as portfolios grow. The challenges are rarely the result of poor execution by individual teams, but rather the consequence of processes that were not designed to scale with asset-level variability and volume.

By recognizing where equipment leases differ from real estate leases and addressing common failure points proactively, organizations can reduce risk, improve reporting accuracy, and maintain visibility without increasing operational burden.

Ultimately, scalable equipment lease tracking is achieved by designing processes that allow additional leases to be absorbed without requiring proportionally more effort. When done correctly, teams can shift focus away from manual tracking and toward analysis, planning, and informed decision-making.

Learn how teams approach this in practice Schedule a demo

Brooke Colglazier

Marketing Manager